Property Tax Course

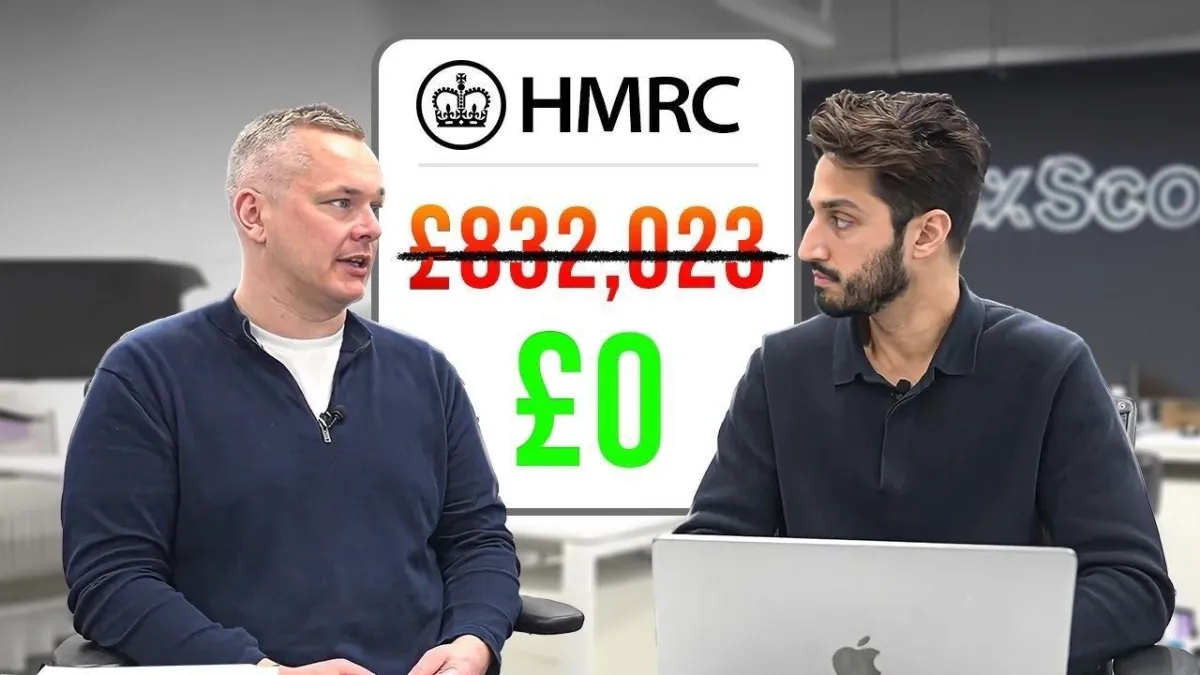

In this tax course I sit down with an accountant to discuss all the recent tax changes, go through every tax which applies to property in 2025 and discuss ways of saving tax.

Headline Will Go Here

Lorem ipsum dolor sit amet consectetur adipiscing elit. Quisque faucibus ex sapien vitae pellentesque sem placerat.

Lessons in this class

39 Lessons

Lessons in this class

10 Lessons

Section 1: Introduction

0:30

Section 2: Section 24 Changes

0:29

Section 3: Stamp Duty Changes

0:47

Section 4: Furnished Holiday Lets Changes

5:28

Section 5: Impact of Tax Changes on Landlords

1:40

Section 6: Benefits of Personalised Tax Advice with TaxScouts

1:08

Section 7: Fundamentals of UK Property Taxation

1:43

Section 8: Capital Gains Tax

0:46

Section 9: Stamp Duty Land Tax

0:25

Section 10: Inheritance Tax

0:21

Section 11: Tax Residency and Domicile

1:30

Section 12: Personal Name

0:22

Section 13: Joint Ownership (& Advantages)

4:52

Section 14: Limited Company

1:12

Section 15: Stamp Duty Land Tax 2

5:31

Section 16: Rental Expenses You Can Claim

3:43

Section 17: How to Avoid Section 24 Changes

0:35

Section 18: Furnished Vs. Unfurnished Tax Implications

2:09

Section 19: Rent a Room Relief

3:23

Section 20: Capital Gains Tax 2

0:36

Section 21: Capital Gains Relief on Residential Property

2:51

Section 22: Capital Gains Tax Relief

2:11

Section 23: When Do You Pay Capital Gains Tax

1:31

Section 24: Avoid Capital Gains Tax Completely

2:43

Section 25: Furnished Holiday Lets Tax

3:01

Section 26: Pros & Cons of Buying in a Limited Company

2:00

Section 27: Taxes in a Limited Company & What Can You Expense in a Limited Company

1:06

Section 28: Claiming a Pension in a Limited Company

4:25

Section 29: How to Take Money Out of a Limited Company

5:19

Section 30: How to Set up a Limited Company

1:03

Section 31: Corporation Tax Return with HMRC

0:41

Section 32: Disadvantage of a Limited Company: Finance

1:09

Section 33: How to Pay Yourself from a Limited Company

0:20

Section 34: Tax Planning Strategies (Future-proofing)

5:07

Section 35: How to File Accounting Records

0:54

Section 36: Common Mistakes with Tax Returns

3:12

Section 37: Tax Implications of Non-Resident Landlords

1:44

Section 38: How to Future Proof Your Property Business

4:00

Section 39: How to Stay Informed About New Tax Changes

1:13

Show All Lessons

Beginner Level

35,000

Students (Views on YouTube)

39

Lessons

About This Class

In this tax course I sit down with an accountant to discuss all the recent tax changes, go through every tax which applies to property in 2025 and discuss ways of saving tax. In this tax course I sit down with an accountant to discuss all the recent tax changes, go through every tax which applies to property in 2025 and discuss ways of saving tax. In this tax course I sit down with an accountant to discuss all the recent tax changes, go through every tax which applies to property in 2025 and discuss ways of saving tax.

Customer Testimonials

Customer Testimonials

This is a brilliant vlog/course. Simplified, easy to understand yet so comprehensive.

Haq Nawaz

This is brilliant thank you! I especially appreciate the info on calculating CGT on a property you used to live in as a primary residence. More research ahead!

Gemma

Great content covering a wide range of topics and issues that can make a great impact on your taxable income. Thank you.

George Rose

Great video, Ahmed! Will share this with my network as it's very useful.

Varma Properties Group

Came back to leave a review. This video was very helpful in getting me to ask the right question to figure out what to do with my flat owned in my name. I was thinking the only way was to sell but the market is not the best. Luckily I have now worked out a strategy that will allow me to keep and the tax burden won't be as harsh. Thank you!

Natasha